Nothing on this website is intended to be, and you should not consider anything on the website to be, investment, accounting, tax, or legal advice. Nothing on this website is a recommendation that you purchase, sell or hold any security, or that you pursue any investment style or strategy. This website does not constitute an offer to sell or a solicitation of an offer to buy or sell any security or investment product, and may not be relied upon in connection with any offer or sale of securities. This material is for the general information of our clients and visitors. Access to information about the investments is limited to investors who either qualify as accredited investors within the meaning of the Securities Act of 1933, as amended or those investors who generally are sophisticated in financial matters, such that they are capable of evaluating the merits and risks of prospective investments. Any such offer or solicitation will be made only by means of the Confidential Private Offering Memorandum relating to the particular investment. After sharing the basic formula for cap rates in one chapter of the book. Under no circumstances should any material at this site be used or considered as an offer to sell or a solicitation of any offer to buy an interest in any investment. In the 11th episode of Purpose-Driven Wealth, your host Mo Bina and guest Brian Burke talk about why the detail-oriented reader-investor would love the book The Hands-Off Investor. No Offer of Securities-Disclosure of Interests LOVE THE SHOW? PLEASE SUBSCRIBE, RATE, REVIEW & SHARE! Waterton is a real estate investment and property management company with a focus on U.S.

#BRIAN BURKE HANDS OFF INVESTOR HOW TO#

What’s going really well with his business. Author Brian Burke, a syndications insider with decades of experience in forming and managing syndication funds, will show you how to evaluate sponsors. What he expects to see now from lenders moving forward. His thoughts on the market trends and coming recession. How he was able to formalize his business model. An Insiders Guide to Investing in Passive Real Estate Syndications. The lessons he learned during the last recession. How he transitioned to multifamily space. How his lack of funds became his starting point.

#BRIAN BURKE HANDS OFF INVESTOR SOFTWARE#

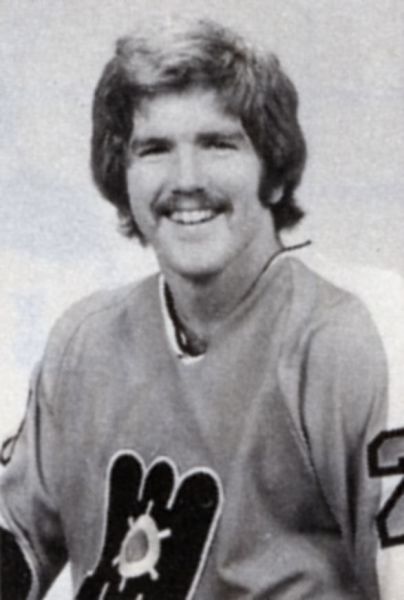

Brian Burke is President / CEO of Praxis Capital Inc, a vertically integrated real estate private equity investment firm.īrian has acquired over 800 million dollars worth of real estate over a 30-year career including over 4,000 multifamily units and more than 700 single-family homes, with the assistance of proprietary software that he wrote himself.īrian has subdivided land, built homes, and constructed self-storage, but really prefers to reposition existing multifamily properties.īrian is the author of The Hands-Off Investor: An Insider’s Guide to Investing in Passive Real Estate Syndications, and is a frequent public speaker at real estate conferences and events nationwide.ĭownload Our Passive Investor Guide to Multifamily Syndications

0 kommentar(er)

0 kommentar(er)